The Argentine peso has suffered a steep plunge in recent weeks, leading investors to sell off Argentinian stocks and bonds in the wake of a bitter defeat in legislative elections in Buenos Aires earlier this month.

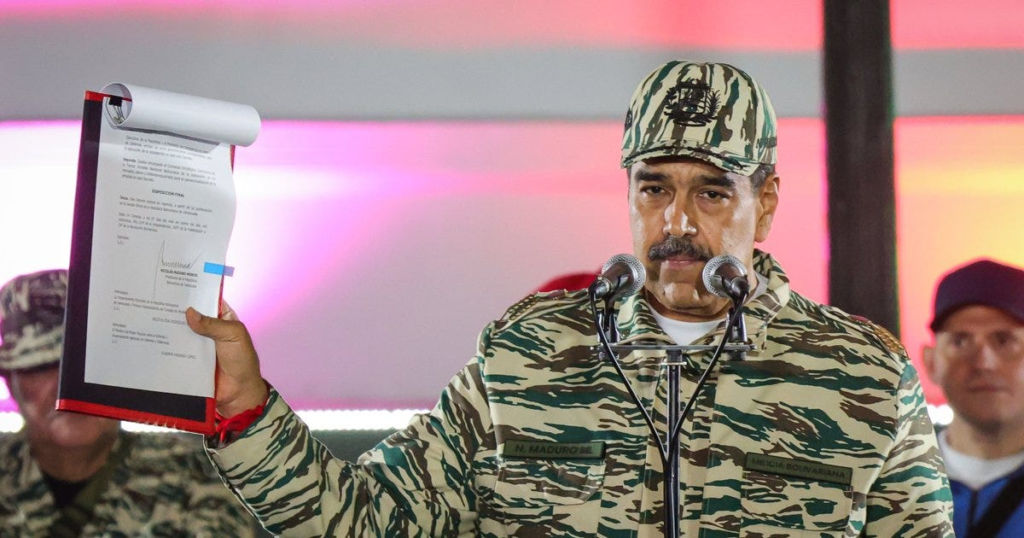

President Javier Milei’s La Libertad Avanza right-wing coalition party was outpaced by the Fuerza Patria, the left-wing Peronist opposition party personified by ex-president Cristina Kirchner.

The defeat spooked investors who are now doubting whether Milei’s harsh austerity program will be carried out.

In order for the program to become successful, the Argentine economy will need to rely heavily on a strong Argentine peso to push the country through the sludge.

A self-described anarcho-capitalist and staunch libertarian, Milei campaigned on the promise of pulling Argentinians out of the depths of a decades-long bout of hyper-inflation and weak economic growth by implementing deep spending cuts and radical fiscal reform.

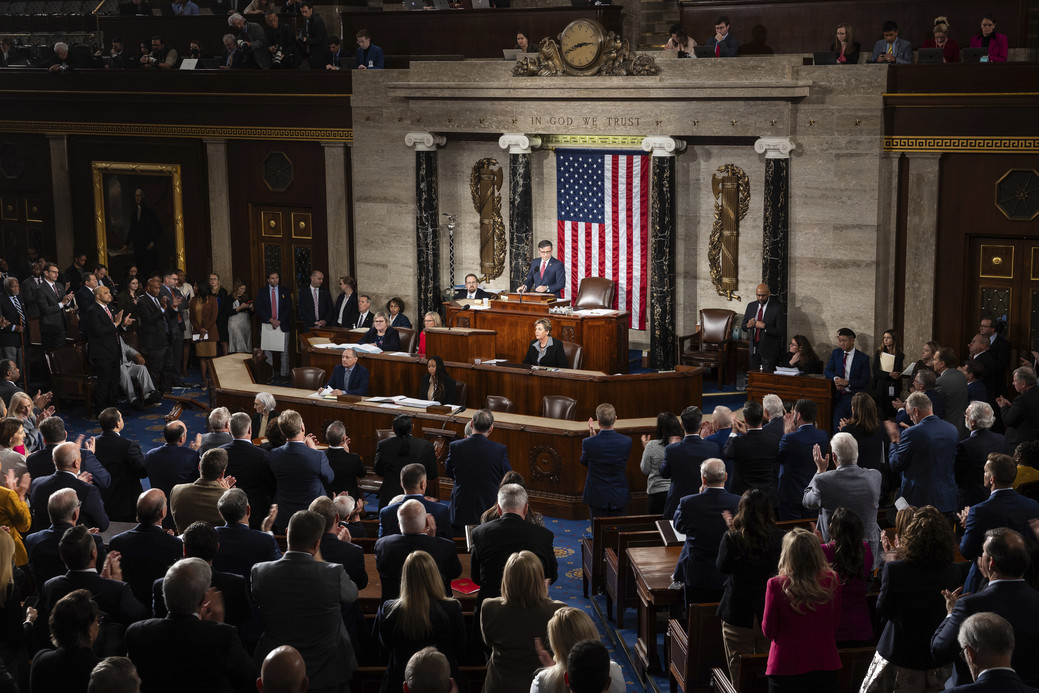

In the wake of a 10% stock market loss in Buenos Aires and a plunging Argentine peso, U.S. Treasury Secretary Scott Bessent interceded earlier today, issuing a statement on X by assuring investors that “Argentina is a systemically important U.S. ally in Latin America” and that the United States “stands ready to do what is needed within its mandate to support Argentina”.

The U.S. Treasury is floating the idea of a financial aid package to restore investor confidence in the Argentine stock market.

However, some of the outer fringes of the Trump MAGA element of the U.S. president’s political base criticized the idea as contrary to his “America First” approach.